INVESTING TO CREATE VALUE – REAL ESTATE

“Investing means the utilization of resources over time with the aim of increasing the capital held and providing a greater level of utility for the entire production system. It is a transfer of resources over time, which implies monetary outflows at the initial stage and inflows at a later stage.”

(Terenzio Somasca, Economia e Valutazione Immobiliare).

Italchimici S.p.A. has always sought to make real estate investments by adapting to changes in the property market, which is currently tending towards the adoption of a profitability model rather than the mere search for an immediate economic return.

This concept of the “active management” of property aims to increase profitability mainly by creating added value and systematically developing the process governing the real estate investment cycle.

The Italian property embodies the concept that the value of a property is determined according to its possible utilisation and profitability.

The property market is becoming more like the securities market in that it associates the main features of a property – namely uniqueness, physicality and immobility – with profitability, the typical feature of a financial market.

Based on these assumptions, the techniques used in securities investment analysis and planning can be transferred to real estate investments.

The main difference between the two main types of investment (which lies in the very nature of the asset) is therefore not incompatible, in that a property is a physical asset, closely related to its context, with intrinsic characteristics, which are only comparable with other property using homologation parameters.

The distinction between the two types of investment lies precisely in the diversity of the product, which has an impact on its liquidity (i.e. the possibility of finding a buyer or seller in real time). The time it takes to convert real estate investments into available funds is much longer than with securities investments.

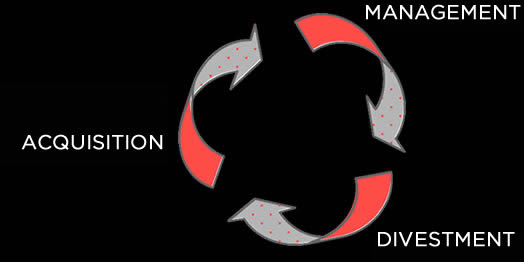

Real estate investments involve processes that could potentially be repeated indefinitely. These processes are the acquisition, management and divestment of assets.

The current property market scenario requires more careful planning and management of the economic, financial and technical variables of the following stages:

When drawing up property investment guidelines, it is of paramount importance to identify the objectives and constraints (determination of the risk and the amount available for investment) by setting out a portfolio business plan. The following parameters then need to be identified:

– type of return required

– duration of the investment

– type of property

– structure of the investment tool

– financial leverage

Monitoring the property market is a strategic move for the entire development of the investment process. Since market conditions are changing all the time, monitoring should take place from the initial assessment of the investment and continue through the stages of management and divestment.

If you know the characteristics of the market in which you intend to operate, you can minimize the risk of the investment.

During the first stage, acquisition, you should identify all the features of the available property able to generate a return (real estate categories, location, size, age, structure of buildings and financing resources).

The main aim of the second stage, portfolio management, is to figure out strategies for re-aligning the actual performance and expected performance of the portfolio.

The last stage, property divestment, consists of identifying the most favourable period and conditions for selling the property. This brings the investment cycle to a close and marks the beginning of a new one with the new investor.